Savings - Yorkshire Building Society

As well as running our core business as Ward House Mortgages & Life we are also a Yorkshire Building Society (YBS) Agency. As an agency for YBS we’re here to help more people save for the things that matter and buy their own home.

YBS agencies are very similar to YBS branches. For many years YBS has partnered with trusted businesses such as ours so that more customers can manage their money with us face-to-face in many more places.

When you visit us you’ll have the same access to your accounts, can open a savings account and can arrange a YBS mortgage. YBS agencies offer you the same excellent service you would expect in any YBS branch and are located in the heart of communities.

Yorkshire Building Society is a mutual organisation, so by opening an account you become a member and have a say in how the business is run. Unlike banks, the Society has no shareholders to satisfy so can focus instead on member’s needs.

To find out how Yorkshire Building Society can help you, call us on 01983 811 505 or pop in for a chat and we’ll be happy to help. You can find us at 39 Union Street, Ryde, Isle of Wight, PO33 2AB.

To find out more about YBS and it’s agencies visit ybs.co.uk/agencies

Yorkshire Building Society is a member of the Building Societies Association and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Yorkshire Building Society is entered in the Financial Services Register and it’s registration number is 106085. Head Office: Yorkshire House, Yorkshire Drive, Bradford BD5 8LJ. ybs.co.uk

Making your money work harder

Just like you need petrol to run a car, money provides you with the means to live your life. Big purchases, holidays, a wedding, emergency reserves to dip into if you find yourself out of work. As you can see, placing some spare cash aside regularly starts to make good money sense.

Picture this, you've just landed a cash bonus or been left a sum of money in a will, what saving vehicle will you choose? There's quite a selection, each offering different terms and incentives.

The first question you should ask yourself is; how quickly do you need access to the money? Would you be prepared to forgo instant access for a higher rate of interest?

Talking to our qualifed staff at our Yorkshire Building Society agency will help you:

· Decide which saving facilities and features are relevant to you

· Pinpoint what you are saving for and how much you'll need to set aside to reach that goal

· Compare the cost of any debts you have accumulated against the interest you are likely earn in savings

· Source the most tax efficient savings account

To discover new ways in which you can make your money work more effectively, contact us today.

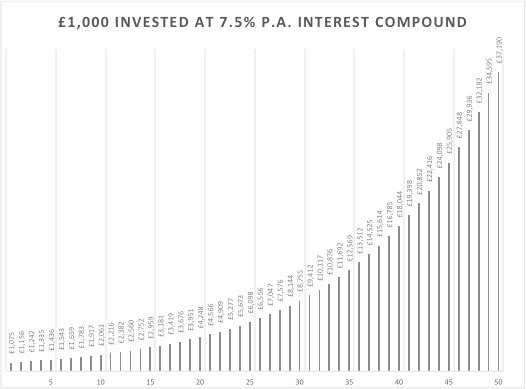

Effects of Compound Interest

The effects of compound interest are remarkable over 5, 15, or even 50 years if you start early enough. For example, at 7.5% p.a compound interest you will have achieved a 43% increase in your money after 5 years. After 15 years it will be worth 3 times your investment and after 50 years, a staggering 37 times your original investment.

No matter how old you are you should be contributing towards your retirement. Many people have switched their main retirement savings towards property (buy-to-let) and ISAs over the last few years. With the recent budget changes we believe every one of us should be relooking at our retirement savings arrangements as pensions are now a much more attractive and flexible savings vehicle than before.

No matter how old you are you should be contributing towards your retirement. Many people have switched their main retirement savings towards property (buy-to-let) and ISAs over the last few years. With the recent budget changes we believe every one of us should be relooking at our retirement savings arrangements as pensions are now a much more attractive and flexible savings vehicle than before.

ISAs

Individual Savings Accounts (ISAs) are available to all UK residents over 18 years of age, 16 years of age for the Cash ISAs. They benefit all taxpayers, as any income or capital gains received from investments held within an ISA do not have to be declared to the tax man.

ISAs can be invested in cash or in stocks and shares (including unit trusts, investment trusts, Open Ended Investment Companies, some fixed interest securities, or any share quoted on a stock exchange recognized by H M Revenue and Customs.) Please note we do not advise on these type of products. When investing your capital is at risk. These investments do not include the same security of capital which is afforded with a deposit account.

Cash ISA's are widely available with different interest rates. It is a good idea to shop around for the best Cash ISA rates. It is important however to understand the conditions attached to those rates, for instance access may be restricted in order to achieve that particular rate.

The overall ISA allowance currently stands at £20,000 for the 2022/2023 tax year. You can take out a Stocks & Shares ISA and a Cash ISA in the same tax year subject to the overall limit applicable to that tax year.